The government of Pakistan has introduced the Karobar Card Loan Scheme to support small and medium enterprises (SMEs) and budding entrepreneurs. This initiative aims to empower individuals by providing them with the financial resources needed to start or expand their businesses, ultimately contributing to the nation’s economic growth. In this article, we will explore the details, benefits, and application process of the Karobar Card Loan Scheme.

What is the Karobar Card Loan Scheme?

The Karobar Card Loan Scheme is a government-backed financial assistance program designed to promote entrepreneurship and economic stability. Through this scheme, eligible individuals can access interest-free or low-interest loans to invest in their businesses. The program prioritizes marginalized communities, especially those struggling to access traditional financing due to lack of collateral or credit history.

Key Features of the Karobar Card Loan Scheme

The Karobar Card Loan Scheme stands out for its comprehensive features aimed at fostering economic inclusivity. Below are the primary highlights:

1. Loan Amount and Tenure

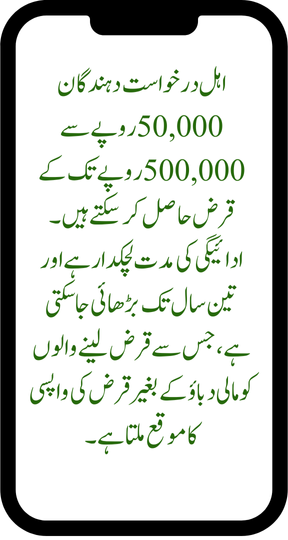

Eligible applicants can avail loans ranging from PKR 50,000 to PKR 500,000. The repayment tenure is flexible, extending up to three years, allowing borrowers to repay the loan without undue financial strain.

2. Interest Rates

The scheme offers interest-free loans for smaller amounts, while slightly larger loans come with minimal interest rates. This ensures affordability for all types of entrepreneurs.

3. Focus on Inclusivity

The program specifically targets women, youth, and individuals from underprivileged areas to encourage widespread participation in the economy.

4. Digital Card System

The Karobar Card is issued to approved applicants, enabling them to withdraw loan amounts conveniently through ATMs or designated partner banks. This digitized system promotes transparency and ease of access.

Eligibility Criteria

To benefit from the Karobar Card Loan Scheme, applicants must meet the following criteria:

- Citizenship: The applicant must be a Pakistani national with a valid CNIC.

- Age Limit: Applicants must be between 18 and 45 years old.

- Business Plan: Submission of a viable business plan is mandatory.

- Income Level: Priority is given to individuals with low-income backgrounds.

- Bank Account: A valid bank account in the applicant’s name is required.

How to Register BISP Complaints Through Helpline Number

How to Apply for the Karobar Card Loan Scheme

Step 1: Gather Required Documents

Ensure you have all necessary documents, including your CNIC, proof of residence, and a detailed business plan.

Step 2: Register Online

Visit the official portal of the relevant government authority or participating banks. Complete the online application form by providing accurate details.

Step 3: Submit Application

Attach the required documents and submit your application online or at designated offices.

Step 4: Loan Approval

Once your application is reviewed and approved, you will receive your Karobar Card and can access the loan amount.

Benefits of the Karobar Card Loan Scheme

The Karobar Card Loan Scheme offers several advantages:

- Financial Independence: It empowers individuals to become financially independent by starting or expanding their businesses.

- Economic Growth: By fostering entrepreneurship, the scheme contributes to job creation and economic development.

- Support for Marginalized Communities: The program ensures inclusivity by prioritizing women, youth, and underprivileged individuals.

A Quick Comparison of Key Details

| Feature | Details |

|---|---|

| Loan Amount | PKR 50,000 to PKR 500,000 |

| Interest Rate | Interest-free or minimal rates |

| Repayment Tenure | Up to 3 years |

| Target Beneficiaries | Women, youth, and low-income individuals |

| Application Method | Online and offline |

Conclusion

The Karobar Card Loan Scheme is a game-changer for Pakistan’s entrepreneurial landscape. By offering financial support with minimal conditions, the program encourages self-reliance and economic progress. Whether you’re a young entrepreneur with a groundbreaking idea or a small business owner looking to expand, this scheme provides the resources to turn your vision into reality. Take the first step today and apply for the Karobar Card Loan Scheme to secure a brighter future for yourself and your community.