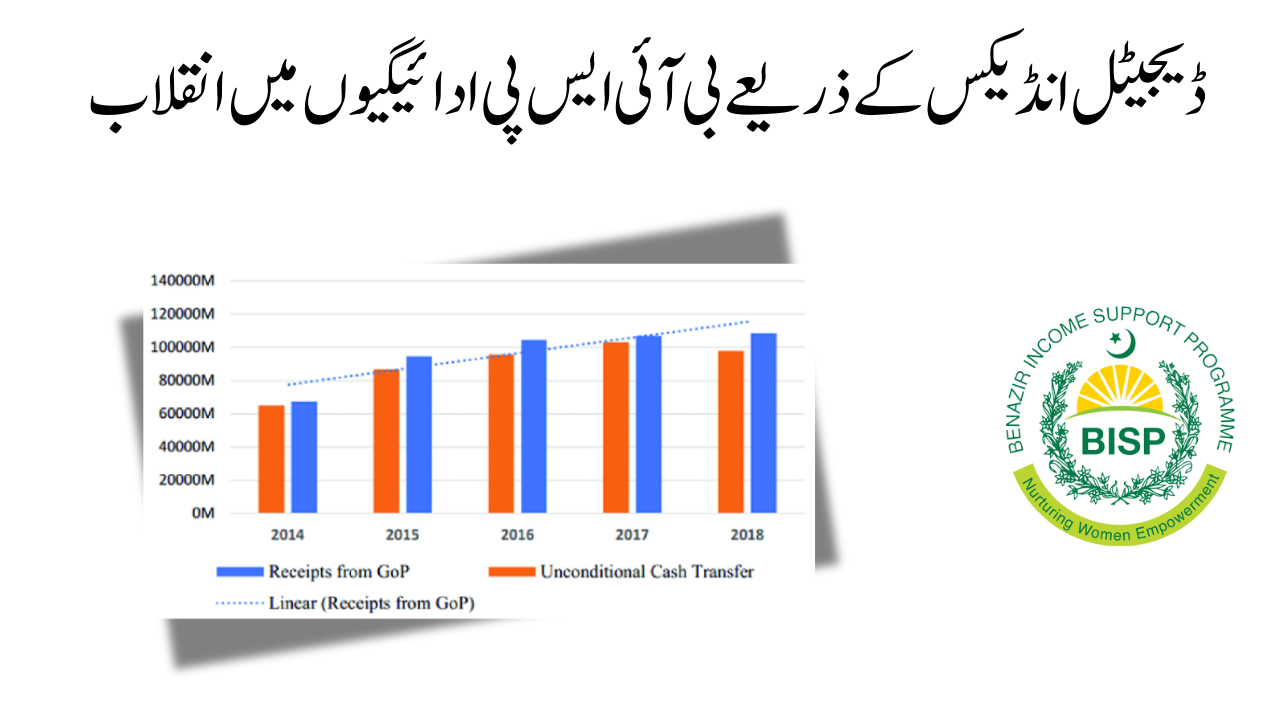

The development of Pakistan’s Digital Payments Index (DPI) marks a significant milestone in the country’s journey toward a digitized financial ecosystem. This index is designed to monitor and measure the progress of digital payment systems across various sectors, providing critical insights into their adoption and impact. By enhancing financial services, DPI aims to foster economic growth and promote financial inclusion, particularly for underserved communities.

What is the Digital Payments Index?

The Digital Payments Index is a tool that evaluates key indicators of digital payment adoption, such as:

- Account Penetration: Number of individuals with access to bank accounts or electronic wallets.

- Payment Enablement: Use of instant payment systems, QR codes, and mobile wage platforms.

- Consumer Awareness: Level of knowledge and comfort with digital payment solutions.

- Transaction Metrics: Frequency and value of digital transactions.

- Infrastructure Readiness: Availability and reliability of internet and mobile networks.

The DPI not only tracks these elements but also provides actionable insights for policymakers and stakeholders to enhance the digital payment ecosystem.

Objectives of the Digital Payments Index

1. Establishing a Trustworthy Indicator

DPI serves as a reliable measure of the progress in digital payment adoption, helping stakeholders monitor development.

CM Maryam Nawaz Approves Construction of 5,000 Classrooms in Punjab Schools

2. Providing Actionable Insights

The index standardizes data into clear, trackable metrics, enabling targeted improvements in the payment ecosystem.

3. Monitoring Progress

By tracking the volume and frequency of digital transactions, DPI aids in evaluating the effectiveness of digitization efforts.

4. Understanding Consumer Preferences

DPI captures data on consumer preferences and challenges, helping to make payment systems safer and more convenient.

5. Benchmarking Internationally

The index allows Pakistan to compare its progress with other countries, identifying best practices and areas for improvement.

Key Benefits of DPI in Pakistan

| Benefit | Impact |

|---|---|

| Financial Inclusion | Helps underserved communities access financial services. |

| Policy Development | Aids in crafting targeted measures for unbanked populations. |

| Enhanced Security | Improves safety measures for digital transactions. |

| Economic Development | Stimulates economic activity by expanding access to financial services. |

Role of the State Bank of Pakistan (SBP)

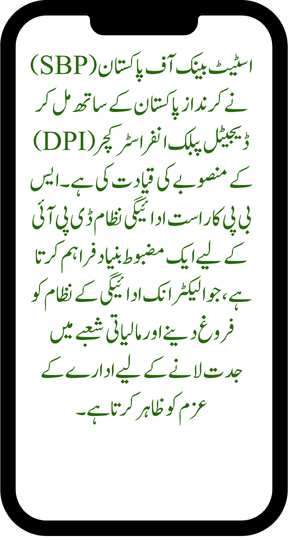

The State Bank of Pakistan (SBP), in collaboration with Karandaaz Pakistan, is spearheading the DPI initiative. SBP’s RAAST payment system has laid a strong foundation for DPI, showcasing the institution’s commitment to advancing electronic payment systems and fostering innovation in the financial sector.

Collaboration with RAAST

RAAST, Pakistan’s real-time payment platform, integrates with DPI to enable instant and cost-effective digital transactions. This partnership is a critical step toward achieving a cashless economy.

Growth Drivers of the Digital Payments Index

- Technological Advancements: Innovations like mobile banking apps and contactless payments are accelerating DPI growth.

- Government Policies: Supportive regulations promote digital transactions and financial inclusion.

- COVID-19 Impact: The pandemic significantly boosted digital payment adoption due to safety concerns.

Trends Shaping DPI in Pakistan

- Mobile Banking Boom: A 16% increase in mobile banking indicates growing adoption.

- E-Wallet Growth: An 85% surge reflects rising user confidence.

- POS Network Expansion: More point-of-sale terminals improve cashless payment facilities.

- Rural Access Programs: Investments in rural areas enhance digital payment penetration.

Future Outlook

Short-Term Trends

- New Payment Technologies: Increased adoption of QR codes and contactless payment systems.

- Regulatory Enhancements: Strengthened frameworks for safer and more efficient transactions.

- Private Sector Collaboration: Partnerships between banks and fintech companies to drive innovation.

Conclusion

The Pakistan Digital Payments Index is a transformative initiative poised to reshape the country’s financial landscape. By offering detailed insights into consumer behavior, market dynamics, and electronic payment trends, DPI supports policymakers, financial institutions, and regulatory bodies. It is a crucial step toward achieving financial inclusion and fostering economic growth in Pakistan. With continued collaboration among stakeholders, DPI promises to position Pakistan as a leader in digital financial innovation.

FAQs

What is the Digital Payments Index (DPI)?

DPI tracks and measures the adoption of digital payment systems in Pakistan, evaluating infrastructure, consumer awareness, and transaction metrics.

How does DPI promote financial inclusion?

DPI identifies barriers to financial access for underserved communities and aids in developing targeted solutions.

What role does SBP play in DPI?

SBP leads the DPI initiative, ensuring robust infrastructure and regulatory frameworks for digital payments.

What are the key metrics for DPI?

Metrics include account penetration, transaction frequency, consumer awareness, and infrastructure readiness.

What trends are driving DPI growth?

Technological advancements, government policies, and increased use of mobile banking are key drivers.